Introduction

Bottom line. Everyone wants to enjoy the prospect of not having to work our entire life. And yes! This can only be achieved through the right investments. There are several ways of doing investments; however this blog will elaborate on two – investing in cryptocurrency vs. real estate crowdfunding.

What is Cryptocurrency?

Cryptocurrency is commonly viewed as a medium of exchange that is created and stored electronically in the blockchain, using encryption techniques to control the creation of monetary units and to verify the transfer of funds. It has no physical form and no central authority or middlemen controlling it. Bitcoin is the best known example of cryptocurrency, comprising the bulk of the market share, at 60.8%. Bitcoin is a digital currency or asset that enables payment in a decentralised peer-to-peer (P2P) network that is powered and approved by the consensus of its users.

Note: There is much more that can be said about cryptocurrency, however that is not the purpose of this post.

From an investment perspective, unfortunately cryptocurrency seems to fall short. Instead, the traits of cryptocurrency are more similar to either “trading” or “gambling”. This is because if you put your money into cryptocurrency, the odds are either you will make lots of money or you will lose every cent of it. Stability seems to be missing in the dictionary of cryptocurrency, which is further affirmed by its volatility behaviour. For example, from November 8th 2017 till November 12th 2017, there was a drastic drop of 21% in bitcoin price BECAUSE of the elimination of anticipated plans to alter its underlying technology. That’s all! Then suddenly the price escalated to almost double the following week!

From an Islamic perspective, volatility which shares similar traits to uncertainty serves as a negative element in fiqh muamalat (Islamic jurisprudence), and falls under the same category as riba’ (usury) and maysir (gambling). This is generally prohibited in Islam. Similar sentiment is shared by Prof. Dr. Humayon Dar, Chairman, President and Chief Executive Officer (CEO) of UK-based Edbiz Consulting Limited when he highlighted that “bitcoin is the biggest fraud of the present time, as it is deceptive in name (it is not a coin), presented as outcome of mining (again deliberately misleading), and has no intrinsic value (against initial claims of those who started it); it is not money at least as of now and is just a useless overpriced security being purchased by speculators driven by greed”.

Real-Estate Crowdfunding Investments

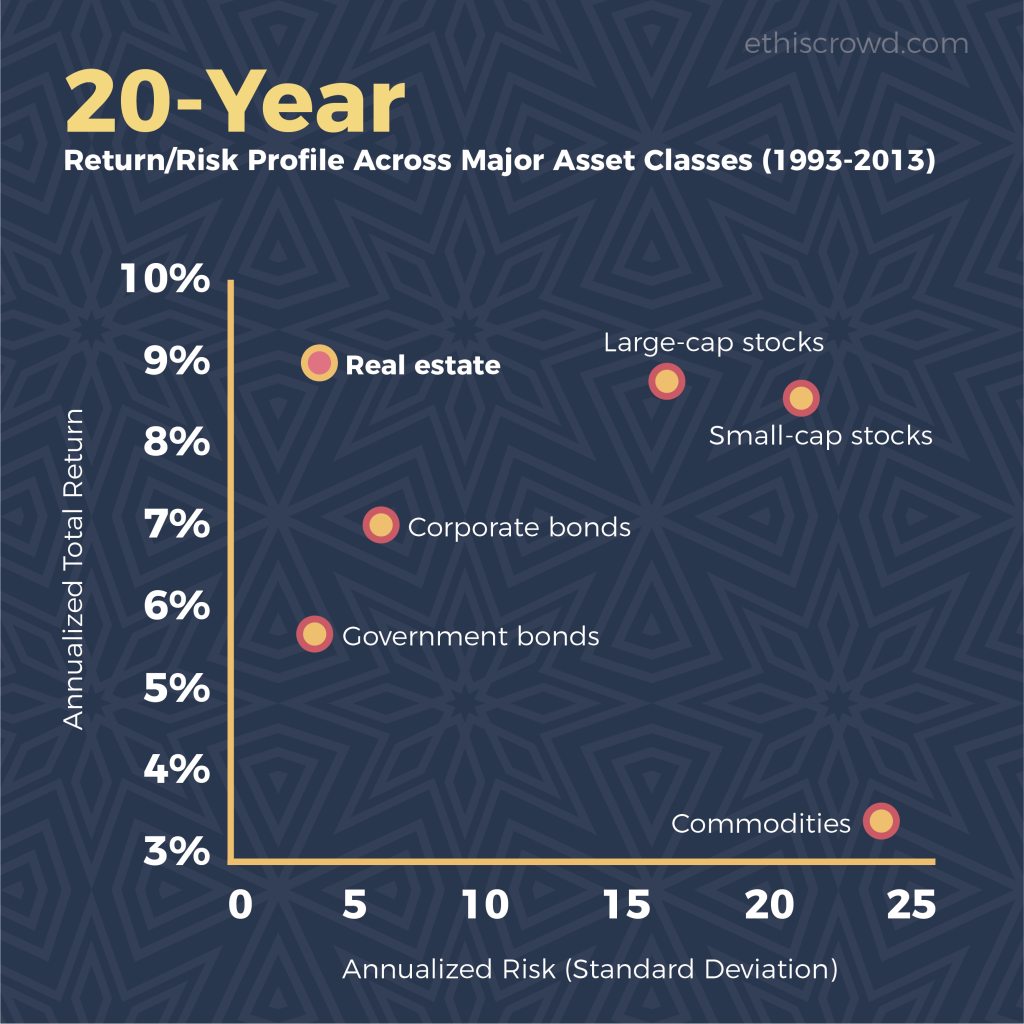

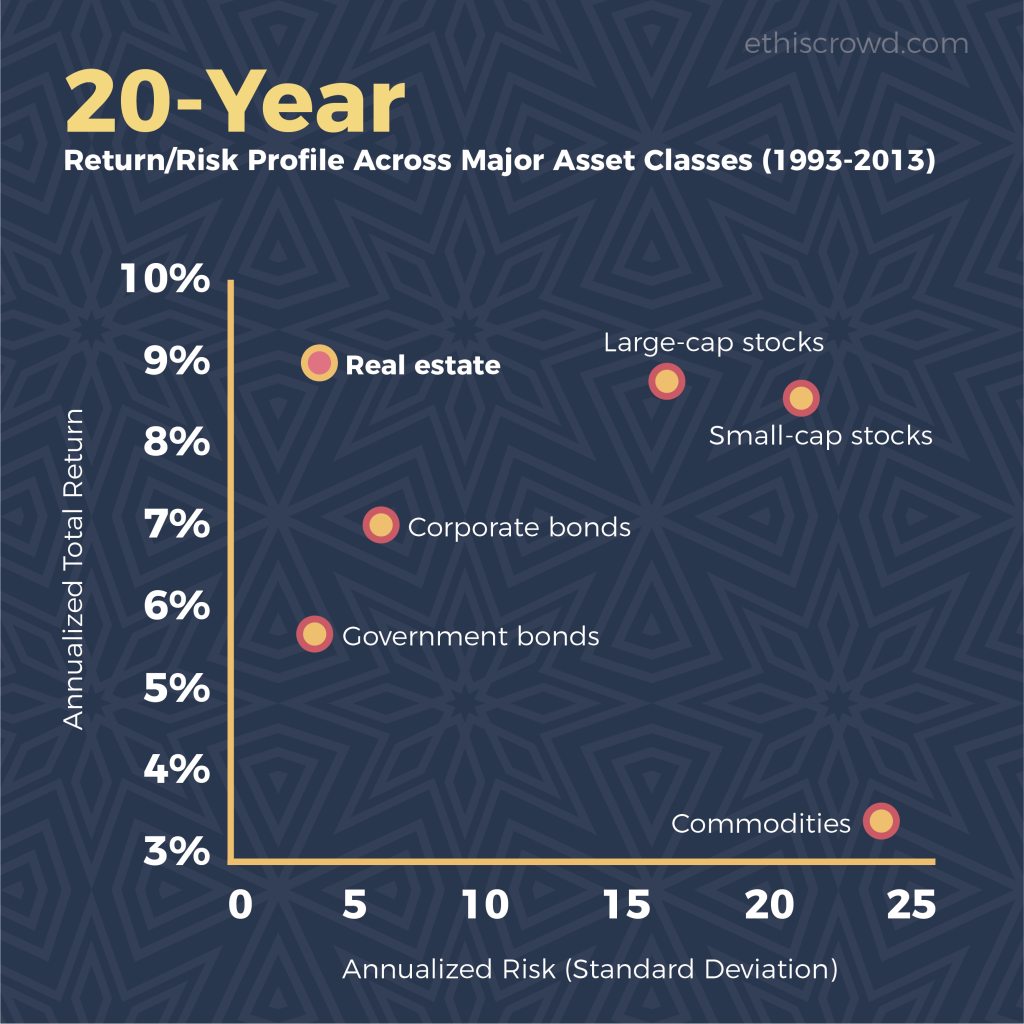

Real Estate Crowdfunding is the exact opposite. With real-estate crowdfunding, there is high likelihood that investors will end up with profits, and it’s unlikely that investments will go to zero. Among the major asset classes, real estate (office, retail, industrial, and multi-family) has by far the best risk-adjusted returns (as illustrated below).

20-Year Return/Risk Profile Across Major Asset Classes (1993-2013)

Source: Thomson Reuters Datastream, Data from 1993-2013

Alongside all the positive effects of real estate investment, real estate crowdfunding investment extends further by enabling investors to access the real estate market while mitigating some of the inherent risks found in all investments. These are some of the advantages of real estate crowdfunding.

Advantages of Real Estate Crowdfunding

Source: Peerrealty.com

As highlighted above, it is clear that real estate crowdfunding offers a lot of benefits to various groups of investors.

An emerging form of real estate crowdfunding focuses on portable social housing developments in Indonesia on Ethiscrowd.com, the world’s first real estate Islamic crowdfunding platform. Ethiscrowd.com provides a win-win situation for investors. When you invest with Ethiscrowd.com, you automatically take part in a noble act – providing homes for the needy, while at the same time earning a healthy return.

Thus far, all of the completed social housing development projects investments under Ethiscrowd.com have provided stable return to investors. However investor need to be aware that there is always the risk of delay, and although unlikely, there is also the risk of capital loss. Risks can be lowered by diversifying your investment into multiple projects and campaigns available on the platform.

It is noteworthy to highlight that through investments with Ethiscrowd.com, investors are directly helping to provide homes for the ummah and needy communities.

Conclusion

Finally, whether it is cryptocurrency or real estate crowdfunding, investors should carefully consider their own investment priorities, objectives and risk appetite. In most cases, when investors are interested in real estate investment opportunities, they may usually find real estate crowdfunding to be right for them.

Check out the Ethis platform here and understand better how crowdfunding campaigns actually work. For more information on the campaigns or to know more on crowdfunding investments, contact maryam@ethis.co.

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You